Cash Handout Registration Set

(To watch the full press conference with sign language interpretation, click here.)

The Cash Payout Scheme will be open for registration from June 21, and Hong Kong permanent residents aged 18 or above on or before March 31, 2021 are eligible to receive the $10,000 payout.

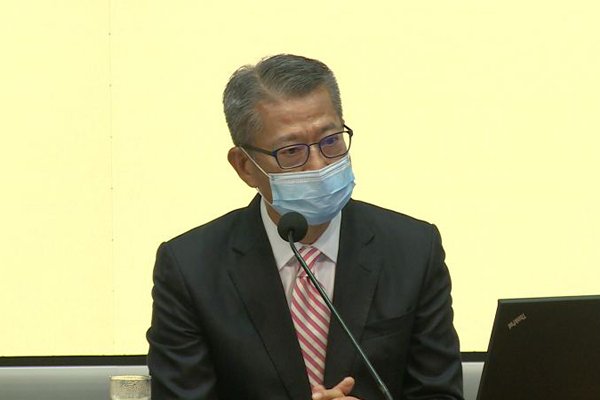

Announcing the scheme’s details today, Financial Secretary Paul Chan said the public can register online through 21 participating banks to have the sum deposited to their personal bank accounts.

Banks will start accepting electronic registrations from June 21 and the scheme’s registration will close on December 31, 2021.

The $10,000 will be deposited into specified bank accounts from July 8 if the online registration is done between June 21 and 30, Mr Chan explained, adding that people who submit electronic registrations on or after July 1 will receive payment about a week later.

People may also submit a paper registration form to banks, but the date of receiving payment will be handled in batches according to the paper form registration arrangement.

Those who wish to receive payment by cheque may submit a paper registration form to Hongkong Post and collect it in person at the post office.

They can also submit an electronic registration form at the Hongkong Post website or paper registration forms to GPO Box No. 182020. No postage is needed if sent from Hong Kong.

Paper form registrations will be conducted in three batches that commence at two-week intervals. The first batch - people born in 1955 or before - may submit the forms from June 21 and receive payment from July 20.

From June 15, paper registration forms will be available from the websites of participating retail banks, Hongkong Post and the scheme.

They will also be available at the Home Affairs Department's Home Affairs Enquiry Centres, the Social Welfare Department's District Social Welfare Offices, public housing estate offices and the Housing Authority’s customer service centres.

The Financial Secretary allayed worries about the personal data collected being misused in the registration process, noting that there is a robust regulatory regime in Hong Kong for privacy protection.

“The Monetary Authority has all along very stringent data privacy requirements in place to make sure the banks are using the data collected properly for banking purposes. The requirement in this respect is the same, regardless of whether it is a virtual bank or a bank with a physical branch.

“When this Cash Payout Scheme is launched, the business sector may roll out different incentive programmes to attract target customers. But we are very confident in our regulatory framework and requirements with regard to the protection of the integrity of data collected by these different institutions.”

Under the scheme announced in the 2020-21 Budget, $10,000 will be disbursed to eligible Hong Kong residents to encourage local consumption and relieve people's financial burden.

Click here for details.

US Stocks Rise On Hopes Of Pause In Rate Increases

Wall Street stocks finished solidly higher on Thursday, reflecting better sentiment on the US economy and a consensus vi... Read more

China's Financial Risks 'controllable': Regulators

The head of the National Financial Regulatory Administration on Thursday told a high-profile forum in Shanghai that the ... Read more

Banks Cut Yuan Deposit Rates, Could Boost Consumption

China's biggest banks on Thursday said they have lowered interest rates on yuan deposits, in actions that could ease pre... Read more

Cheese And Wine Put EU, Australia Deal In Peril

Australia on Thursday threatened to walk away from a blockbuster free trade deal with the European Union unless its prod... Read more

US Stocks End Mixed As Tech Shares Are Sold Off

Gains by industrial companies lifted the Dow on Wednesday, while weakness among technology shares pushed the Nasdaq deci... Read more

Amazon 'plans Prime Video Streaming Service With Ads'

Amazon.com is planning to launch an advertising-supported tier of its Prime Video streaming service, the Wall Street Jou... Read more